About This Toolkit

This toolkit provides an overview of actions your business can take to reduce your energy costs, lower your carbon emissions, and become more sustainable. It is split into the following sections:

- Billing, Monitoring, Decarbonisation and Net Zero – this section discusses measuring and monitoring your consumption, how to report your emissions and how to get to Net Zero.

- Energy Efficiency – how you can use less gas and electricity through a combination of behavioural modifications and capital investment in more energy efficient technologies – e.g., LED lighting.

- On-site generation – ways to power your business without relying on the grid.

- Fleet and Travel – can your business reduce the emissions associated with its fleet and staff travel to and from the office?

- Waste and the Circular Economy – tips on minimising waste and how to make the most of what others don’t need.

- Climate Resilience and Adaptation – how to prepare for the effects climate change will have on our society, and your business.

These sections are designed to give an overview of each area and will contain links to further resources which provide more in-depth help and advice. The toolkit will be expanded over time to include additional topics and bespoke advice for additional businesses.

Key Tips

The energy crisis and climate emergency are at the forefront of everyone’s thoughts. Your business can tackle both problems by following the tips set out below, which will help you to reduce your energy bills as well as your carbon footprint.

- Install a smart meter and monitor your energy (gas and electricity) consumption. In addition, you should also monitor your fuel receipts and deliveries of oil, LPG, diesel or other fuels to site. It is important to know how much gas and electricity you are using (in kWh) and how much fuel is delivered to site or used by your fleet (in litres, L).

- Make staff aware of your consumption and how much it is costing the business. Start a behavioural awareness and modification campaign to reduce consumption. This might involve :

- An opening up and closing down routine to ensure lights, heating, appliances and equipment are switched on only when they are needed and are switched off at the end of the day

- Using timers on the heating, and the full use of thermostatic radiator valves (TRVs) instead of opening windows

- Dressing appropriately for the season, wearing jumpers in the winter to keep warm and avoid using the heating, and shorts, skirts and T-shirts in the summer to avoid the use of the air conditioning.

- Switching off lights when leaving any room

- Turning down the heating by (at least) 1C

- Avoiding leaving external doors open

- Avoiding standby on all appliances

- Upgrade all of your lighting to LEDs

- Insulate your building/premises/site as much as possible

- Once insulated, investigate upgrading your heating to a low carbon heating solution (e.g. heat pumps, IR panels or biomass boilers).

- Consider on site generation such as solar (or wind, if applicable).

- Investigate offsetting/sequestration

Where Should I Start?

There is a lot for you to understand, think about and investigate. It can (quite reasonably) feel daunting and difficult to know where to start. This toolkit is ordered roughly in the order you should consider things. Firstly, your billing and monitoring needs to be addressed – do you know how much you are using, and are staff aware of your consumption and their responsibilities to reduce it?

Once you have looked at billing and behavioural aspects, it is then time to consider where to invest money (if you can afford it) to minimise your consumption/emissions in the long term. There may be some opportunities for quick wins which require only a small investment – perhaps changing some light bulbs to LEDs or installing draught excluders.

However, insulation is also a contender for the initial project. Loft or cavity wall insulation will both reduce your heating bills considerably if they are appropriate for your building, and, although it is a more expensive option, installing double or triple glazing in some area should also be considered if single glazing is currently installed.

Generally, other projects such as a replacement heating solution or solar panels should only be considered after lighting and insulation have been upgraded. Lighting will alter your electricity demand, which affects how large the solar array needs to be for optimum returns. Likewise, improving the insulation of your building could mean you no longer need such a large (and expensive) heating solution.

Monitoring and Bills

Collecting your billing and consumption data for gas, electricity and fuel is important to allow you to monitor your usage and identify opportunities to save. This data can allow you to make an estimate for how much you are using for different activities.

Setting up a spreadsheet can help you keep track of your consumption for gas and electricity. A generic version of this can be accessed by emailing: climatechange@southtyneside.gov.uk

This is the first and most important step in your efficiency and decarbonisation journey. Understanding how much you are using (and, if possible, when you are using it) will help you to identify opportunities to reduce waste and keep your bills as low as possible.

Power and Energy

Power is measured in kW (kiloWatts) and is similar to speed. Energy is measured in kWh (kilowatt-hours) and is similar to distance. So, travelling at 100mph for 1 hour is the same distance as travelling at 25mph for 4 hours. Likewise, running one 20kW heater at full power for one hour will use the same energy as running two 5kW heaters at full power for two hours.

De Minimus Threshold

How much VAT you pay, 5% or 20%, is determined by your consumption and the ‘de minimus threshold’. If you use more than 1000kWh of electricity in a month, or 4397kWh of gas, you will pay 20% VAT on these bills. In addition, businesses that use less than the de minimus threshold are also exempt from the Climate Change Levy (CCL).

Smaller businesses should keep an eye on their consumption, VAT rate and if they are paying the CCL. If you have overpaid, you may be entitled to a refund.

Charitable Status

Organisations with charitable status can apply to have the VAT reduced to 5% and be exempt from Climate Change Levy payments.

Estimated Readings

Unless you have a smart meter, your supplier cannot know how much electricity and gas you have used unless you provide them with a meter reading. If you do not provide them with a meter reading they will generate an estimated reading based on previous consumption which is used to bill you.

Estimated readings can sometimes be wildly inaccurate. For example, if you have upgraded your lighting to more efficient LEDs but haven’t provided your supplier with an updated reading they may charge you based on your previous consumption despite the fact that you’re using much less now.

If you don’t have a smart meter, you must submit regular meter readings to your energy supplier for accurate bills. Otherwise, you may be overcharged, or repeatedly undercharged without realising, which can lead to a nasty shock a few months/years down the line!

Smart Meters

It is recommended that you contact your supplier to have a smart meter fitted if you have not already. This means you will never have to send your supplier another meter reading, and you will never have another estimated meter reading. In addition, smart meters give network operators a clearer picture of local consumption, which will facilitate gird upgrades and can provide you with half hourly data for better analysis of when you are using energy.

Monitor Your Energy

Taking regular meter readings, at least once a month, will ensure your bills are accurate and you are not being overcharged. Even with a smart meter installed, it important to check it periodically so it isn’t simply an ornament.

Staff Engagement

No matter how diligent you are, it will be difficult to reduce your energy costs without the support and cooperation of your staff. Make people aware of the energy costs associated with running your business and how much energy is being used.

Keep them informed with regular updates. This might be through monthly meetings, or on a bulletin board or through periodic emails. Whichever form of communication you choose, consistency is key.

The Energy Saving trust have lots of useful resources around staff engagement, which can be found by clicking the link below: https://energysavingtrust.org.uk/business/employee-engagement-resources/

Set an Achievable Target

You ought to consider setting a savings target, (for example, 5% of your consumption which is small to enough to be reached without financial investment but large enough to show an appreciable difference to your bills and carbon footprint). This target can represent reduction in both gas and electric, or just one. Alternatively, you could set a target consumption each month or year – just make sure this is realistic!

Appoint an Energy Champion

You might well find some members of staff are already passionate about environmental issues and will happily help to manage your energy. Appointing an energy champion to work with your staff on their habits will improve your chances of hitting any targets you set.

Go Paperless

Paper bills have a larger carbon footprint than electronic bills. Not only does the paper and ink create emissions, but the vehicle used to transport the letter to your premises will also create emissions. An email containing your bill as a pdf still has a carbon footprint, but it is much smaller than a physical bill.

Power Capacity

Large businesses may use a lot of power, and this is sometimes charged separately on your electric bill. Power capacity (or just ‘capacity’) is the amount of electricity you can draw from the grid at once without incurring an additional charge.

Installing solar, LEDs, following best practice at times of peak demand and buying more efficient appliances and equipment (such as compressors and computers) can all help to reduce this cost.

Red, Amber and Green Electricity charges

Large businesses may also be charged a premium for the electricity they use, depending on what time of day it is used. At peak time, about 4pm to 7pm on weekdays, large businesses will be charged the most for their electricity. Green charges cost the least and tend to be over nights and weekends. This billing mechanism is designed to reduce the demand on the national grid at peak time.

If your business is subject to these billing mechanisms, you should encourage staff to be especially vigilant about lights, computers and monitors and charging and using equipment at peak times.

Greenhouse Gas Emissions

Our civilisation has historically been powered by fossil fuels – coal, oil and gas. Unfortunately, these fossil fuels emit a byproduct with negative consequences for our environment: greenhouse gases. These emissions trap heat in our atmosphere that causes climate change. For more information on this, you can read the IPCC’s report on the Physical Science of Climate Change, by clicking this link: https://www.ipcc.ch/report/ar6/wg1/

Alternatively, this Youtube video provides a more succinct explanation: https://www.youtube.com/watch?v=M2Jxs7lR8ZI&ab_channel=SciShow

Your Business’ Carbon Footprint

Whatever your business involves, it will be creating greenhouse gas emissions. The energy you use to warm up and illuminate your building, the fuels used to travel to work and transport your goods, as well as the waste you produce and all the energy required to extract and refine the raw materials needed to make and package the products you use and create.

We must reduce these emissions to zero, overall. Currently, it is not possible to reach zero for the time being, as the solutions do not exist. However, we can minimise our energy and transport requirements, eliminate unnecessary waste and then ‘offset’ the remainder of the emissions.

Offsetting will soon become very expensive, and its therefore much more important to reduce your emissions before you think about offsetting them.

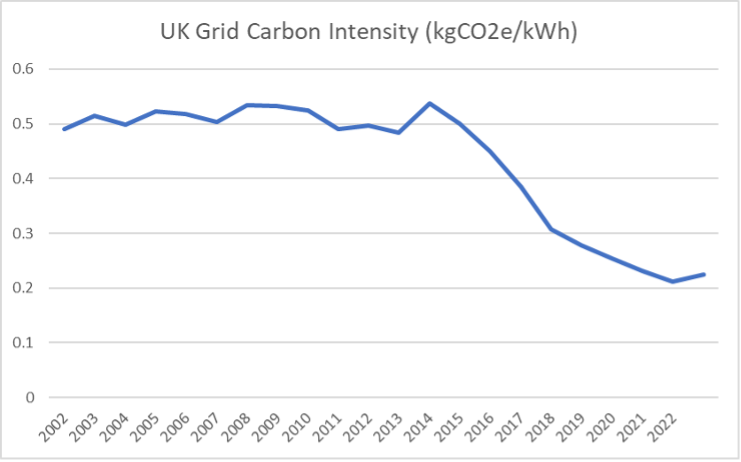

This may seem like a daunting task. However, as a rising tide lifts all boats, the reverse is also true. So, as you and your business acts to decarbonise so does everyone around you. The UK National Grid has reduced its carbon intensity by more than half in the last decade (as illustrated below) and by seeking out suppliers who are also working to become more sustainable you can help to accelerate our civilisation’s journey to Net Zero.

To learn more about greenhouse gases, climate change and how it might affect your business, consider checking out the Carbon Literacy Project, which offers courses that can help you understand greenhouse gas emissions and how you (and your business) can act to become more sustainable.

Click here to learn more: https://carbonliteracy.com/

Types of Greenhouse Gas Emissions

There are several different greenhouse gases. These are carbon dioxide, methane, nitrous oxide and then a number of different types of refrigerant gases. Although the refrigerant gases are the most potent, they are produced in relatively tiny amounts compared with the others. Carbon dioxide is by far the most prevalent and therefore causes the most damage to our environment, so greenhouse gas emissions are reported in terms of CO2e – Carbon Dioxide equivalent. This comprises carbon dioxide and other greenhouse gases, all to the same relative potency.

When reporting your emissions, it is best practice to report in terms of CO2e.

Types of Emissions

Your emissions are split into 3 categories: Scope 1, Scope 2 and Scope 3, depending on how they are produced.

Scope 1 and Scope 2

These are your operational emissions and generated through the direct or indirect use of energy. They typically account for 10% – 20% of a business’ overall footprint.

Scope 1 (direct emissions) come from burning fossil fuels – e.g., gas in a boiler, or petrol and diesel in a car engine. Scope 2 (indirect) emissions are the result of someone else burning fossil fuels that you/your business benefits from indirectly. For most businesses, this is the use of electricity only, although steam, heating and cooling may also count for certain businesses.

Scope 1 and 2 emissions are straightforward to monitor. They simply require data on how much electricity, gas, petrol and diesel, and any other fuel source your business uses annually.

Example: A restaurant in South Shields uses 100 000kWh of electricity and 100 000kWh of gas each year. In addition, they also purchase 1000 litres of diesel for their van each year.

Their operational emissions can be calculated by multiplying these figures by the relevant carbon factor (see where to find these factors below).

- For electricity, this is 0.22499kgCO2e per kWh, meaning the restaurant’s electricity usage produces 22 499kg of CO2, or 22.5 tonnes.

- For gas this factor 0.18293kg/CO2e, meaning the restaurant’s gas usage produces 18 293kg of CO2e, or 18.3 tonnes.

- For diesel this factor is 2.51kg/litre, meaning the restaurant’s diesel usage produces 2510kg of CO2e, or 2.5 tonnes.

In total, the restaurant’s overall operational emissions are 43.3 Tonnes per year.

These carbon factors (in bold) are published by central government and updated each summer. Click here to view these government figures: https://www.gov.uk/government/collections/government-conversion-factors-for-company-reporting

Scope 3

Scope 3 incorporates emissions from your business’ supply chain, purchased goods and services, packaging, waste, staff commuting, and business mileage.

While Scope 3 can be difficult to report for smaller businesses, simplified tools are being created to streamline this process. For now though, it is best to concentrate your efforts on monitoring and reducing Scope 1 and 2 emissions, since this is where you have direct control.

To learn more about Scope 3 emissions, click here: https://ghgprotocol.org/scope-3-calculation-guidance-2

Setting a Net Zero Target

All businesses need to aim to decarbonise and become Net Zero. Not only is this vital for the future of our civilisation, but early adopters will benefit from reduced operating costs and will also likely avoid emissions related tolls and levies (for example, early adopters of electric vehicles have benefitted from not needing to pay Clean Air Zone charges).

However, a reasonable target might be to aim to be Net Zero for 2030 across operational (Scope 1 and 2) emissions. This requires you to eliminate or minimise emissions produced by gas and fuel as well as minimising electricity consumption. As explained above, Scope 3 emissions are difficult to monitor for small businesses and even more difficult to minimise.

How do I get My Business’ Operational Emissions to Net Zero?

Example: The restaurant mentioned in the earlier example has decided on a target of becoming Net Zero by 2030. They switch their heating and cookers to electrically-powered alternatives and replace their diesel van to an electric model.

In addition, the restaurant installs LED lighting and solar, improves insulation, and trains all staff to be as energy conscious as possible. Their diesel and gas usage falls to zero, but electricity usage increases overall despite the efficiency upgrades as it is now used to power their heating and van. The restaurant now uses 120 000kWh/yr of electricity.

By 2030, the National Grid has continued to decarbonise with wind, solar and nuclear power displacing coal and gas. However, it is not Net Zero yet and each kWh of electricity still produces 0.1kg/CO2e.

Therefore, the restaurant’s annual carbon emissions are now just 12 tonnes per year. With time, the grid is expected to become completely Net Zero and the restaurant’s emissions will fall to zero. However, to be Net Zero by 2030, in line with their target, they will need to offset these 12 tonnes per year (see below: Offsetting).

What About Scope 3 Emissions?

As mentioned earlier, Scope 3 is difficult for small businesses to address. It covers your supply chain (including the food they purchase), as well as waste, water and staff travel to work (among other things). Calculating these emissions is currently an expensive and time-consuming exercise involving specialist contractors.

However, it is expected that this will change over the next few years as our understanding of Scope 3 improves, and less expensive and easier to use tools become available.

The restaurant could set a target of achieving Net Zero across Scopes 1, 2 and 3 by 2040. Beginning in the late 2020s, the restaurant could begin monitoring its water consumption and waste production, survey staff on how they get to work, and start using suppliers who also monitor their emissions. This allows them to calculate an estimate for their overall Scope 3 emissions.

By encouraging staff to travel to work by walking, wheeling, and using public transport (or carpooling) this element can be reduced. Waste and water can be reduced, and supplier emissions will naturally fall as those businesses also decarbonise

The remainder of their emissions will need to be offset, just like the outstanding 12T/yr of Scope 1 and 2 emissions.

More information on monitoring and reporting Scope 3 emissions can be found by following this link: https://ghgprotocol.org/scope-3-calculation-guidance-2

You can also attend specialist courses on Carbon Reporting. Click here to learn about one of these courses offered by Northumbria University: https://www.northumbria.ac.uk/study-at-northumbria/continuing-professional-development-short-courses-specialist-training/carbon-champion-carbon-footprinting-management-and-reporting/

Offsetting and Sequestration

What Is Offsetting?

Offsetting is where you pay to have emissions you produce balanced out by a project or business elsewhere absorbing carbon dioxide from the atmosphere or preventing emissions from occurring elsewhere.

How is CO2 Absorbed?

Currently, this usually involves planting trees which absorb CO2 as they grow. Unfortunately, this option on its own will never be enough to balance out all of the emissions we are currently producing – no matter how many trees are planted (without considering historic emissions). Although tree planting has numerous benefits apart from storing carbon and is strongly encouraged it is not the answer on its own.

Other options are to suck greenhouse gases directly out of the atmosphere and store it underground where it can’t escape. Peatland restoration is another option – the UK’s peatlands are the country’s biggest carbon store.

The above options are forms of Carbon Sequestration – removing carbon from the atmosphere and locking it away somewhere.

Offsetting can come in other forms too. Some schemes reduce emissions by investing in projects that eliminate future emissions. For example, if a country has a particularly carbon intensive electricity grid then investing money in the building of a solar farm could be considered offsetting. The electricity produced by the solar farm will displace other, more polluting electricity sources. This, and other similar schemes are contested by some, as no carbon is actually sequestered through his process.

How Much Does It Cost?

Offsetting is usually measured per tonne of CO2, with current prices estimated to be £10 – £30 per tonne. However, this figure fluctuates massively between offsetting schemes and is expected to increase in the future as more businesses look to offset. By 2030, this figure could easily be £1000/tonne or more, as demand outstrips supply.

When Should My Business Offset?

Offsetting should be the last thing a business considers. Offsetting should be implemented only after your business has implemented staff energy awareness training, upgraded your lighting and equipment to the most efficient models available, and insulated your building as much as you are able. Follow the guidance in the other sections of this business toolkit before offsetting whatever emissions remain.

Offsetting before these options have been exhausted means your business will be paying money to be Net Zero indefinitely, without seeing any reduction in its bills.